R-G's Free Personal Financial Management Tool

Save hundreds of dollars every year by tracking spending, setting goals and establishing realistic budgets. Login to your R-G Federal Credit Union Online Banking account to get started!

Why use sumitup?

SUMitup gives you financial control and saves you time and money. You'll know where your money goes, how much you are saving, and be able to set goals and track progress. You can sync accounts with nearly 20,000 financial institutions.

Our Goal:

your financial wellness

In these challenging times, it's hard to feel like we're in control. But you can still stay on top of your finances with the help of your Cash Flow Calendar. Cash Flow is key to understanding what and when money is coming and going in your account - and we've made it easy for you to set up and track.

getting started:

Add An Account

Syncing other accounts in SUMitup for a complete financial picture is simple. Then you can track your account relationships with almost all financial institutions automatically, including credit card providers and investment firms. Once all your accounts are synced, track spending, set budgets, calculate your net worth and more.

- Step 1: Navigate to Accounts and click the plus sign to “Add Linked Account.”

- Step 2: Select an institution or use the search to find your institution.

- Step 3: Enter in the required information and select "Connect.”

You'll receive a notification on your SUMitup dashboard once the account has been synced successfully.

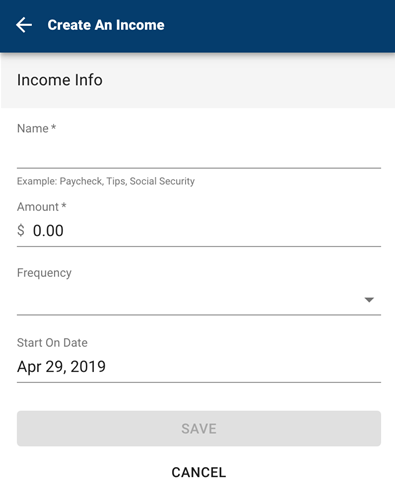

Cash Flow Calendar

The cash flow calendar brings your budget to life through an interactive calendar. With the calendar you can see how much money you have available to pay bills and other expenses day by day... allowing you to make informed choices on when to schedule bills and other spending.

- Step 1: Navigate to Cashflow.

- Step 2: Click the plus sign to "Add Income" or "Add Bill.”

- Step 3: Enter in the required information and select “Save.”

Your bill or income will now appear in the SUMitup calendar for you, whether it’s a monthly, weekly or quarterly payment.

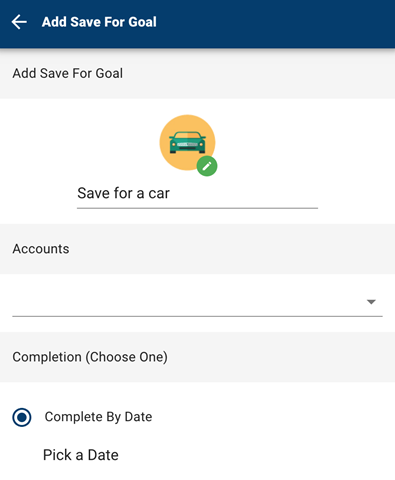

Goals

Visually tracking your financial goals can help you take control and makes reaching your goals much quicker and easier. Create savings goals in SUMitup, like saving for a vacation, or a debt reduction goal, like paying off a high-rate credit card.

- Step 1: Navigate to Goals and select “Add Goal.”

- Step 2: Select your desired pay off or savings goal.

- Step 3: Fill in the required information.

- Step 4: Click the "Save" to complete the process of adding a new goal.

Keep in mind, your Goal Summary will update your completion date and the amount needed per month according to your preferences.

Goals will automatically update your progress and will reflect your day-to-day account balances in SUMitup.

Login to your Online Banking account or launch the Mobiliti App to get started!

Questions about R-G Federal Credit Union SUMitup?

Phone

866.852.6478